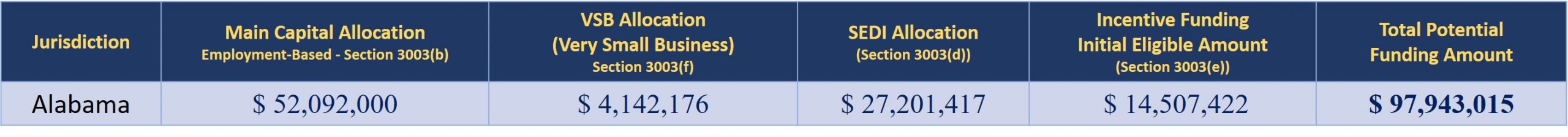

Treasury Policy and Guidelines: Capital

Allocations for States Territories Washington DC and Tribal Governments (November 2021)

This document identifies the funds allocated pursuant to Sections 3003(b), (d), and (f), and the initial eligible amounts available under Section 3003(e), to states, territories, the District of Columbia, and Tribal governments (in aggregate), under the State Small Business Credit Initiative (SSBCI) Act of 2010 (the Act), as amended by the American Rescue Plan Act of 2021 (ARPA).

Published November, 2021

Capital Program Policy Guidelines (November 2021)

This U.S. Treasury Department Document covers the policies and guidelines for SSBCI Technical Assistance funding and instructions on how to apply.

Published on November 10, 2021

Capital Program Reporting Guidance (Updated May 25, 2022)

This Capital Program Reporting Guidance details the reporting and document retention requirements for jurisdictions that receive SSBCI funding (“participating jurisdictions”).

Published on May 25, 2022

Compliance and Oversight Narrative Template

This document serves as an example and template for Staff Compliance and Oversight required as part of the SSBCI Capital Program. It provides examples on describing the reporting mechanisms, audits, or other internal controls and compliance activities for annual and quarterly reporting requirements.

Published on April 14,2021

State Small Business Credit Initiative (SSBCI) Program Fact Sheet (November 2021)

This document provides a general overview and outlines key facts and points of the SSBCI Program as defined in The American Rescue Plan Act of 2021.

Published November 2021

Treasury Issues State Small Business Credit Initiative Program Implementation Guidance (Press Release November 10, 2021)

This Press Release authored and published by the U.S. Treasury Department announces the publishing of the SSBCI 2.0 Program Implementation and key Guidance.

Published November 2021

Tribal Government Fact Sheet (Updated August 18, 2021)

This document provides a general overview and outlines key facts and points of the SSBCI Program as it relates to Tribal Governments as defined in The American Rescue Plan Act of 2021.

Published on August 18, 2021

Enrolled Loan and Leverage Ratio Tables User Guide

This guide serves as a reference for filling out the Enrolled Loan Data Table for Capital Access Programs (CAPs) and the Leverage Ratio Data Table for Other Credit Support Programs (OCSPs)

Published on February 02, 2022