SSBCI Related State Legislation: A-F

ALABAMA

MORE HELP IS ON THE WAY FOR ALABAMA SMALL BUSINESSES

News/Media Article – Alabama

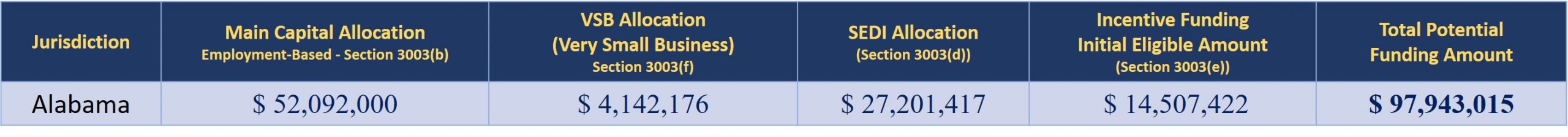

On February 11th, the Alabama Department of Finance applied to the US Treasury Department for Alabama’s portion of SSBCI funding. The State of Alabama was so serious about getting its share of SSBCI funds and using this program as a shot in the arm to our state’s economy that our leaders went a step further than was required. The application outlined how we plan to use the money and even included legislation that was crafted to ensure the success of the program.

Published By: Business Council of Alabama

Published Date: March 24, 2022

ALABAMA

ALABAMA SEEKS TO BOOST INNOVATION THROUGH INCENTIVES

Report

The Alabama Innovation Commission has released an incentive-heavy set of proposals to promote innovation and entrepreneurship in the state

Published By: Alabama Innovation Commission 2021 report

Published Date: January 11, 2022

ALASKA

AK-ARPA BUSINESS RELIEF PROGRAM

AK-ARPA Business Relief Program

The Alaska State Legislature appropriated $90 million from the State’s American Rescue Plan Act (ARPA) Covid State and Local Fiscal Recovery Funds (CSLFRF) toward a tourism and business relief grant program to be administered by the Department of Commerce, Community, and Economic Development (DCCED). Approximately $34 million remains to be distributed under the second round of this program.

Published By: DEPARTMENT OF COMMERCE, COMMUNITY, AND ECONOMIC DEVELOPMENT

Published Date: May 19, 2022

CALIFORNIA

STATE SMALL BUSINESS CREDIT INITIATIVE (SSBCI)

[Categories Go Here]

In California, SSBCI-funded programs are administered by both the California Pollution Control Financing Authority, housed within the California State Treasurer’s Office and the California Infrastructure and Economic Development Bank (IBank), housed within the Governor’s Office of Business and Economic Development.

Published By: CPCFA SSBCI

Published Date: February 4, 2022

CALIFORNIA

STATE SMALL BUSINESS CREDIT INITIATIVE

Article

The State Small Business Credit Initiative (SSBCI) was originally created through federal legislation – the Small Business Jobs Act of 2010. The program is designed to help states address the challenges small businesses face in securing financing.

In California, SSBCI-funded programs are administered by both the California Infrastructure and Economic Development Bank (IBank), housed within the Governor’s Office of Business and Economic Development, and the California Pollution Control Financing Authority, housed within the California State Treasurer’s Office.

The American Rescue Plan Act of 2021 reauthorized and funded a new version of the original SSBCI program, providing a combined $10 billion to states and Tribal governments to empower small businesses to access capital needed to invest in job-creating opportunities. The funds will also support promotion of American entrepreneurship and democratize access to startup capital across the country, including in underserved communities.

Published By: California Infrastructure and Economic Development Bank

Published Date: February 4, 2022

CALIFORNIA

STATE SMALL BUSINESS CREDIT INITIATIVE

Assembly Hearing

The American Rescue Plan Act of 2021 (ARPA) included $10 billion to provide for a second round of State Small Business Credit Initiative (SSBCI). The SSBCI was initially created through the Small Business Jobs Act of 2010. Treasury’s implementation of the SSBCI program is designed to expand access to capital, promote economic resiliency, and create new jobs and economic opportunity. The IBank submitted this summary of the SSBCI and California’s applications.

Published By: California State Assembly Hearing

Published Date: March 29, 2022

CALIFORNIA

JOINT HEARING ON SSBCI AND INCLUSIVE ECONOMIC GROWTH

California State Assembly - Joint Hearing

The Assembly Committee on Jobs, Economic Development, and the Economy (JEDE) and the Assembly Budget Subcommittee 4 on State Administration are convening a joint informational hearing examining the state’s use of $1.18 billion in federal State Small Business Credit Initiative funding.

Published By: California State Assembly Hearing

Published Date: March 29, 2022

CALIFORNIA

AN OVERVIEW OF THE STATE SMALL BUSINESS CREDIT INITIATIVE

Legislative analyst’s office

Act provided $10 billion to reauthorize SSBCI. Of this amount, California has been allocated an estimated $1.2 billion. About half of this amount was allocated based on California’s 2020 unemployment rate. Other funds are available to states that meet goals for funding to businesses owned and controlled by socially and economically disadvantaged individuals (SEDI). Other amounts are reserved for tribal government loan programs, technical assistance programs, and other administrative costs.

Published By: Assembly Committee on Jobs, Economic Development, and the Economy

Published Date: March 29, 2022

CALIFORNIA

IBANK SSBCI VENTURE CAPITAL PROGRAM STATUTORY CHANGES AND POSITIONS

State of California Budget Change Proposal

SSBCI was funded with $1.5 billion to strengthen state programs that support financing of small businesses. California received $168 million of the $1.5 billion and the Infrastructure and Economic Development Bank (IBank) and the California Pollution Control Financing Authority (CPCFA) – an agency housed within the State Treasurer’s Office (STO) split the funding equally between the two agencies

Published By: IBank SSBCI Venture Capital Program Statutory Changes and Positions

Published Date: May 13, 2022

COLORADO

Colorado State Small Business Credit Initiative

Colorado Programs and Funding

With the new SSBCI funds, we expect to be allocated $104,773,554 and to receive these dollars in late summer 2022. In addition to strengthening capital programs that support private financing to small businesses, SSBCI is also intended to ensure more equal access to startup capital across the country, including in underserved communities. As part of its participation in SSBCI, the State will ensure funds are deployed to very small businesses and those owned by socially and economically disadvantaged individuals

Published By: Colorado Office of Economic Development & International Trade

Published Date: August 25, 2021

CONNECTICUT

NEW 2022 COVID-19 RELIEF FOR CT BUSINESSES

State of Connecticut

Most small businesses have heard of the PPP and EIDL programs for COVID assistance. However, there is a new federal program called SSBCI (State Small Business Credit Initiative). In July 2022, the United States Treasury has approved Connecticut to receive up to $119 .5 million in federal funding. As part of the American Rescue Plan Act, the SSBCI in Connecticut aims to help underserved and clean environmentally focused companies recover from the pandemic.

Published By: State of Connecticut SSBCI 2022 Covid-19 Relief for Business

Published Date: July 27, 2022

CONNECTICUT

GOVERNOR LAMONT ANNOUNCES FEDERAL APPROVAL OF CONNECTICUT’S PLAN TO SUPPORT ENTREPRENEURS AND SMALL BUSINESSES GROWTH WITH COVID RECOVERY FUNDING

State of Connecticut Office of the Governor Press Releases

(HARTFORD, CT) – Governor Ned Lamont today announced that the U.S. Treasury Department has approved the State of Connecticut’s plan to deploy up to $119.5 million in funding through the American Rescue Plan Act’s (ARPA) State Small Business Credit Initiative (SSBCI).

Published By: State of Connecticut Office of the Governor

Published Date: July 18, 2022

DELAWARE

STATE SMALL BUSINESS CREDIT INITIATIVE (SSBCI) 2.0

State of Delaware Programs

The U.S. Department of Treasury is administering a second installment of the State Small Business Credit Initiative (SSBCI) as part of the American Jobs Plan passed in 2021. Delaware will receive Treasury funding to provide small business financing and technical assistance to help small and diverse businesses become capital ready. Check back on this page in the future for more information or to participate in SSBCI 2.0.

Published By: State of Delaware Division of Small Business

Published Date: July 05, 2022