SSBCI CAPITAL ACCESS PROGRAMS (CAP)

SSBCI 2.0 Capital Access Programs (CAP)

SSBCI 2.0 provides for States, Territories and Tribal Governments to expand existing or establish new Capital Access Programs (CAP). Under SSBCI 2.0 – Capital Access Programs – provide portfolio insurance in the form of loan loss reserve funds into which the lender and borrower contribute and are supplemented with SSBCI funds.

What is it?

CAP is a small business credit enhancement program that creates a specific cash reserve fund for a lender to use as additional collateral for loans enrolled in the program by the lender.

SSBCI CAP Overview

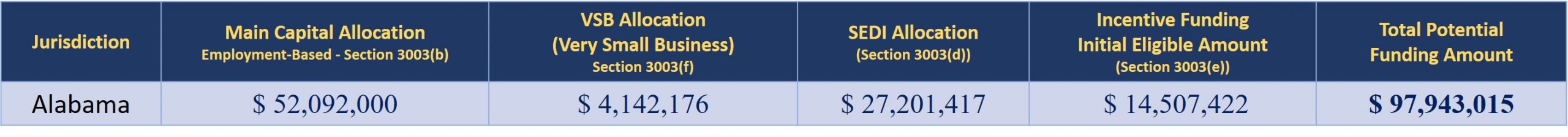

Providing States, Territories and Tribal Governments with funding for small businesses

Capital Access Programs (CAPs) provide portfolio insurance to lenders that make small business loans. Portfolio insurance is provided in the form of a separate loan loss reserve fund for each participating financial institution. To enroll a loan in the CAP, both the lender and the borrower must make insurance premium payments to the reserve fund.

The State, Territory or Tribal Government must make a matching insurance premium payment to the reserve fund. The matching payment to the reserve fund may be made with the State, Territory or Tribal Government’s allocated SSBCI funds.